Happy 2024! Green also means eternally fecund in its way, much like this day, much like you yourself. You are ready to fruit!

I take this moment to wish you well and to recommend some recent readings (though of course they should be required). In lieu of takes or reviews, some digressions on how I came to them or vice versa.

Re-visioning Psychology, by James Hillman. The late JH is/was a close friend of a close friend, so one-degree and all. But I had never read him. Representative sample:

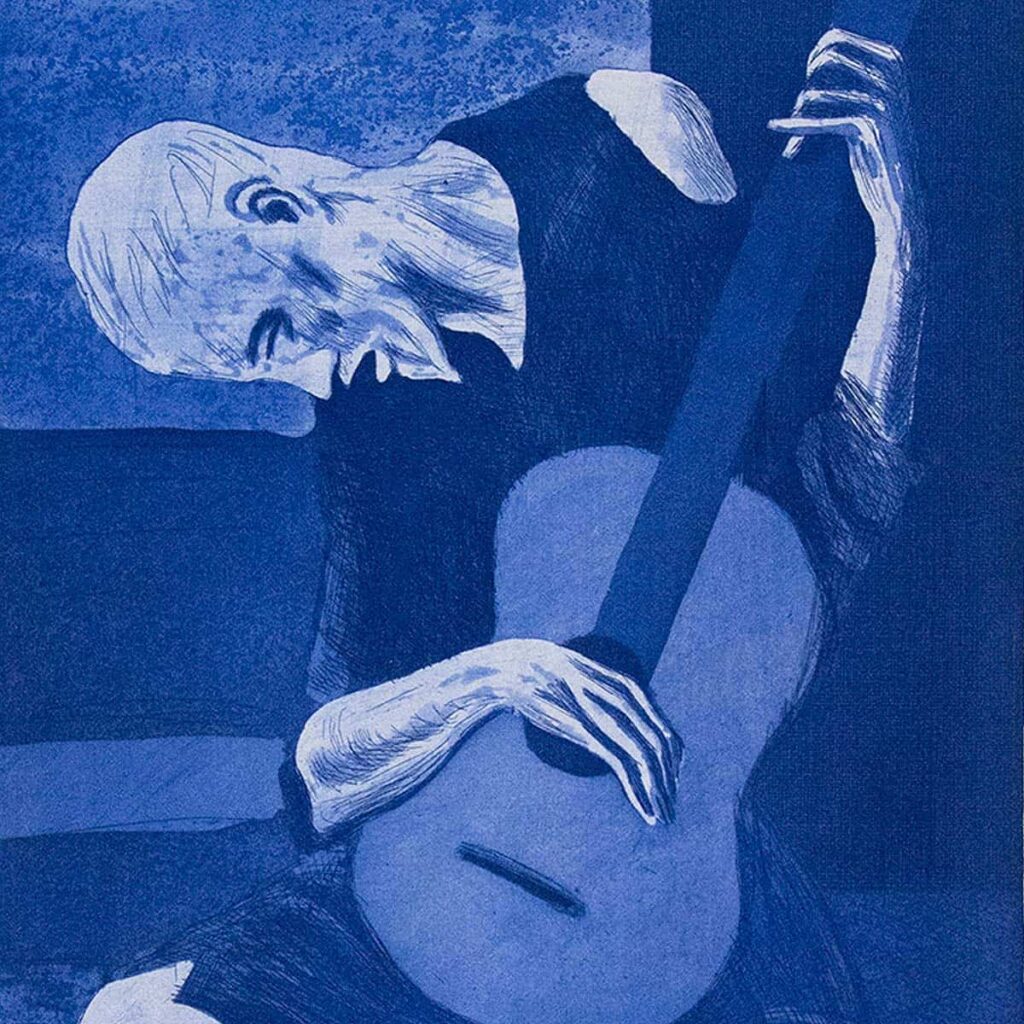

We sin against imagination whenever we ask an image for its meaning, requiring that images be translated into concepts. The coiled snake in the corner cannot be translated into my fear, my sexuality, or my mother-complex without killing the snake. We do not hear music, touch sculpture, or read stories with meaning in mind, but for the sake of the imagination. Though art may hide a multitude of psychological ignorances, at least it does not ask images what they mean. Interpretations and even amplifications of images, including the whole analytical kit of symbolic dictionaries and ethnological parallels, too often become instruments of allegory. Rather than vivifying the imagination by connecting our conceptual intellects with the images of dreams and fantasies, they exchange the image for commentary on it or digest of it. And these interpretations forget too that they are themselves fantasies induced by the image, no more meaningful than the image itself.

Upon the death of Tom Verlaine one year ago, Patti Smith wrote a touching and very generous remembrance/eulogy/essay about him and their relationship. Avoid your heroes, yes, but checkout the obits. Smith shared some terrific authors she learned of or read with Verlaine, some which were unknown or little known to me but contiguous of the tight circle I know well, of which I tracked down

The Blind Owl, by Sadegh Hedayat

Love with a Few Hairs, Mohammed Mrabet

Laziness in the Fertile Valley, Albert Cossery

Other honorable mentions:

Trouble in Mind, a play by Alice Childress

Answer to Job, by Carl Jung

Ask the Dust, John Fante

Disgrace, J.M. Coetzee

So… push yourself into your greatness in 2024. Find a way. Fight the fascists. Punch the nazis. Vote like women’s healthcare depends on it (it does) and like we’re about to turn a corner on climate change (we could be), all of which and more are very much in the balance and under threat. Do it and be just.

Thanks for reading. Always free.