NBA commentator Jeff Van Gundy’s well-placed, near-extemporaneous “back at the crypt” comment notwithstanding, ubiquitous references to crypto currency range from annoying to cloying. Everything about digital money is either scammy or… that seems to be mostly it. Scammy neatly encompasses the over-hyped, Ponzi-schemed, last-one-in nature of the the collection of binary data that necessarily requires us to put all the usual finance-related terms in quotes: “ownership” “collateral” “token” “transaction.” You could go on.

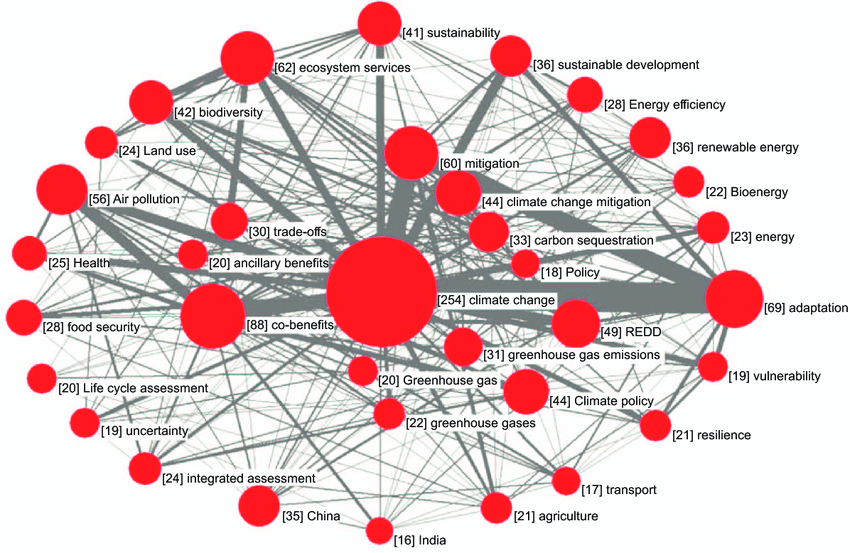

And besides the obvious downsides of NFT’s – from terrific money-laundering possibilities to the proliferation of really bad art – we’d be remiss in not noting crypto’s climate impacts:

Crypto’s overall climate impact remains massive, with certain currencies swallowing up entire nations’ worth of processing power from individual computing units and data centers—much of whose power comes from fossil fuels. The most common form of cryptocurrency mining, proof of work, requires a massive amount of processing power. Alternative mining methods have a mixed track record so far, with some ostensibly “sustainable” mining systems still requiring significant amounts of dirty or clean power. And transacting any tokens across the blockchain, whether an NFT or a Litecoin, sucks up the collective energy feeding into the transaction, no matter the product at hand. One estimate claims that a single NFT trade across the much-used Ethereum blockchain uses enough energy that could power an entire house for several days. And this is all so the buyer can have bragging rights about “owning” an image.

Celebrities who are selling NFTs and also claim to care about the environment: What are you doing? Whatever it is, there sure are a lot of you. Here’s a list—surely incomplete—of luminaries who brand themselves as climate-conscious yet have also been hawking NFTs in some form or the other, ensuring this bizarre digital culture product will linger in the public discourse while possibly ruining the art world, the planet, and our collective sanity.

Not even-close-to-exhaustive list of scam-adjacent proponents at the link. Yes, engaging in yet another form of workaround for doing not the things we need to do about global warming: what are we doing? The climate question at the center of everything, that we’ve been needing to ask for decades, that we still need to answer.

Image: the crypt in question