This Financial Times article (subscription req’d) pulls back the curtain on rain forest destruction in Brazil to let us see what – and who – it’s all for:

At the recent UN climate summit in Glasgow, more than 100 national leaders committed to halt deforestation by 2030, and 30 financial institutions, including Storebrand, promised to eliminate the harmful practice from their portfolios by 2025. However, the signatories, including Brazil, Russia and Indonesia, did not indicate how it would be implemented or tracked, and environmental campaigners remain sceptical.

ADM and Bunge are among the world’s largest traders moving Brazilian soyabeans around the world. The increase in production of the commodity, largely used for livestock feed, has been a leading cause of deforestation of the Amazon rainforest as well as the destruction of Cerrado savannah.

The scale of soyabean production on deforested land and differing standards about what qualifies as acceptable activity makes tackling its presence in supply chains challenging for companies.

Both Bunge and ADM strengthened their deforestation policies last year in response to calls from shareholders. Storebrand, together with US fund manager Green Century, tabled a proposal at Bunge’s annual meeting asking it to tighten its policies, which was backed by 98 per cent of shareholders. Bunge has said it is committed to not having soyabeans from illegally deforested land.

As much as even the big fund managers and many governments get on board with divestment and ESG priorities in managing portfolios, this really points up the issue: the companies – and countries – who burn and mine for profit just aren’t going to give it up as long as it’s profitable. The whole ‘fiduciary responsibility to shareholders’ is baked into our ethos, as long as there is money to be made, dividends to be paid, stock to buy back, whatever.

For allies in COP26 and elsewhere, the approach has to include the goal to dismantle, and then re-assemble, the demand side. It’s worth being realistic about this – otherwise, we remain [eternally? That’s optimistic – ed.] captive to supply-side economic logic. As the ADM example highlights, the companies will never lead anywhere besides mining, digging, clearing, and burning.

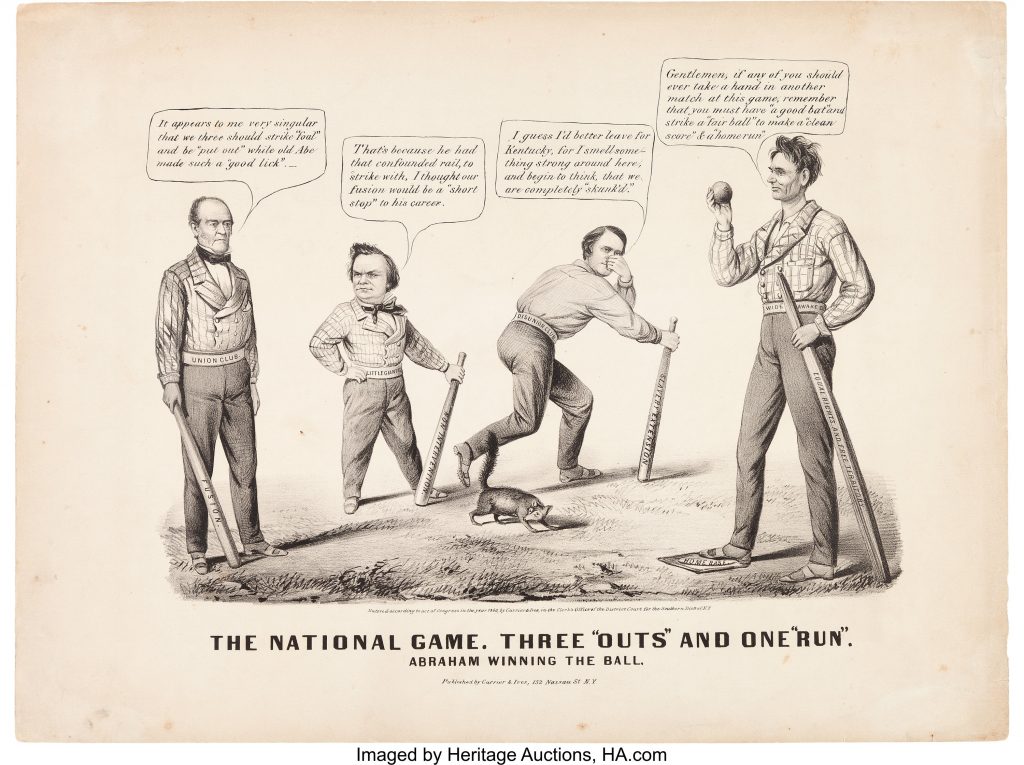

Image via FT.com © Ricardo Beliel/Brazil Photos/LightRocket/Getty Images