Not to pick on MIT Tech Review – though kicking Silicon Valley is another story and actually fine – but this story reads quite a bit like VCs trying to re-invent the bus:

At Living Carbon, Mellor is trying to design trees that grow faster and grab more carbon than their natural peers, as well as trees that resist rot, keeping that carbon out of the atmosphere. In February, less than four years after he co-founded it, the company made headlines by planting its first “photosynthesis-enhanced” poplar trees in a strip of bottomland forests in Georgia.

This is a breakthrough, clearly: it’s the first forest in the United States that contains genetically engineered trees. But there’s still much we don’t know. How will these trees affect the rest of the forest? How far will their genes spread? And how good are they, really, at pulling more carbon from the atmosphere?

Living Carbon has already sold carbon credits for its new forest to individual consumers interested in paying to offset some of their own greenhouse gas emissions. They’re working with larger companies, to which they plan to deliver credits in the coming years. But academics who study forest health and tree photosynthesis question whether the trees will be able to absorb as much carbon as advertised.

Even Steve Strauss, a prominent tree geneticist at Oregon State University who briefly served on Living Carbon’s scientific advisory board and is conducting field trials for the company, told me in the days before the first planting that the trees might not grow as well as natural poplars. “I’m kind of a little conflicted,” he said, “that they’re going ahead with this—all the public relations and the financing—on something that we don’t know if it works.”

Re-engineering trees, okay. Super-charged trees. His misgivings are right there, as are the preconditions of going ahead with this: ‘headlines’, ‘public relations and financing.’ Like they just came out of nowhere.

I, too, want super trees to be a thing. But c’mon. Strauss is actually quoted in the article saying, “There could be a negative. We don’t know”

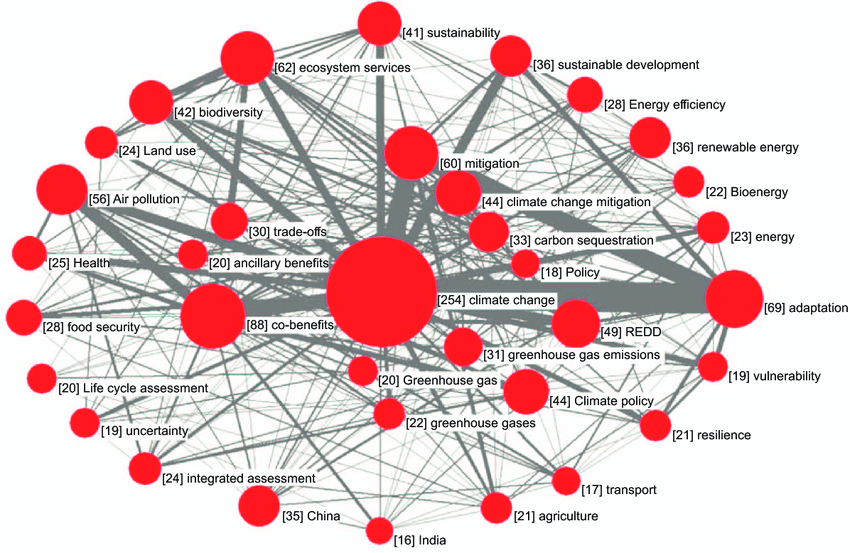

The point is that Climate Solutions Hype (patent pending) continues to outstrip existing effective solutions that we just don’t like, are bored with or wish were sexier and have become one more dynamic with which the Earth must contend. Along with irony.

Image: Regular Lombardy Poplar tree (also quite super).

In early September 2008, I drove down to Charleston to visit a cousin who had recently suffered a terrible accident. Throughout the drive I listened to extended public radio reports on an evolving calamity: the collapse of Lehman Brothers financial services firm. The horror that the government was going to allow such a large firm to go under was decorated with the baroque gadgetry of terms that would become more familiar in the coming years: credit default swaps, subprime mortgage lending, tranches, CDOs. The gore and detail of the cover that had been constructed around scams and fraud at the broadest level was audible in the voices of interviewers and guests. There was a tinge of disbelief within their attempts to explain what these terms meant and how they had gotten us all (!) into so much peril. It was as close to 1929 as we had come and potentially far worse – so extensively had the giant vampire squid of financial engineering welded its tentacles to every sector. Housing, banking, investing, construction, debt, bonds… this is business America now, and every other activity is vulnerable to its caprice. It was the stretch run of a presidential election as well; one candidate tried to suspend the campaign, the other fortunately tried to hold things together.

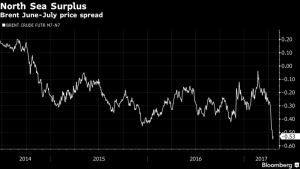

In early September 2008, I drove down to Charleston to visit a cousin who had recently suffered a terrible accident. Throughout the drive I listened to extended public radio reports on an evolving calamity: the collapse of Lehman Brothers financial services firm. The horror that the government was going to allow such a large firm to go under was decorated with the baroque gadgetry of terms that would become more familiar in the coming years: credit default swaps, subprime mortgage lending, tranches, CDOs. The gore and detail of the cover that had been constructed around scams and fraud at the broadest level was audible in the voices of interviewers and guests. There was a tinge of disbelief within their attempts to explain what these terms meant and how they had gotten us all (!) into so much peril. It was as close to 1929 as we had come and potentially far worse – so extensively had the giant vampire squid of financial engineering welded its tentacles to every sector. Housing, banking, investing, construction, debt, bonds… this is business America now, and every other activity is vulnerable to its caprice. It was the stretch run of a presidential election as well; one candidate tried to suspend the campaign, the other fortunately tried to hold things together. We wish they were more rare. But just as rising wages are bad news for business(?) and solar most horribly spells doom for coal, word in the oil game is that consistent catastrophes are needed

We wish they were more rare. But just as rising wages are bad news for business(?) and solar most horribly spells doom for coal, word in the oil game is that consistent catastrophes are needed