First of all Happy New Year and apologies for going blank for a while. We were hacked! And I’m not naming

First of all Happy New Year and apologies for going blank for a while. We were hacked! And I’m not naming Russians names, but THANK YOU to someone special for getting this thing back up and running.

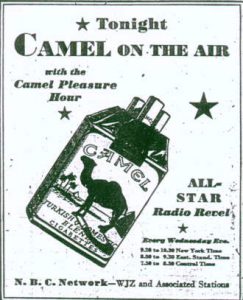

So… when the FCC gave licenses to stations to broadcast advertisements beginning in July 1941, they negotiated public service programming commitments as a requirement for a license. These were initially 15-minute current events recaps. But when Pearl Harbor was bombed later that year, the national emergency gave way to extensive special reporting that led to everything form newsreel theatre to interview and expose shows – John Cameron Swayze and Camel News Caravan to, eventually Edward R. Murrow himself and See It Now, the first program with live simultaneous transmission from coast to coast.

So the public affairs arena became profitable and something happened to it. We can connect other phenomena, and we should (the advent of Pop art), but all this happened in a way that seemed positive, fortuitous and in many ways divine. But we weren’t nearly savvy enough to keep the news boring enough to keep ourselves informed long enough to figure how we should treat these new information delivery systems that were so engrossing we would just sit down and watch… anything.

Now they have become useless for informing us – but they didn’t start out that way! The diminution has been deliberate, but informing people could be a viable business model! But, and this is serious, the quarterly profit expectations will have to be vastly curtailed. And this is only part of the problem. But let’s begin.

Art into Business

I know a lot of people, sure don’t we all. And I know many of them think this ‘slide’ is a horse that departed the barn, found the violin factory and played no small part in a performance of the Brandenburg concerto in 1971. Okay, fine.

But still. I’m going to interview the critic Jed Perl for my show in a month or so. He had a recent piece out about the Met director and Davos and well, horse… barn… Brandenburg D minor 7th:

“We need to make our case with metrics, framed in a language that businessmen understand.” That’s what Thomas Campbell, the director of the Metropolitan Museum of Art, had to say the other day, while attending the World Economic Forum in Davos. My heart sank when I read these words. They may be the saddest words ever spoken by the director of a major museum. Campbell had begun by complaining that at Davos culture was “an add-on,” “the entertainment”—and I can sympathize with his frustration on that score. But Campbell’s problem—and more than five years into his tenure it’s beginning to look like Campbell’s tragedy—is that at the first sign of frustration he’s ready to turn art into a business.

I’ve been told by people close to Campbell that I misunderstand him. I’ve been told that deep down he’s still the scrupulous scholar who as a curator at the Metropolitan produced what are probably the two greatest tapestry shows ever mounted in a museum. But the gifts that make a great curator (visual refinement, historical imagination) are not necessarily the gifts required to be a great museum director, who must make the case for art’s elusive, transcendent powers in the face of a world dominated by the rapacity of metrics, big data, and businessmen who live and die by such measures. I don’t think Campbell meant any harm to the arts when he argued at Davos that what he called “the culture industry” had to connect with the rest of the world “at a deeper socioeconomic level.” The effect of Campbell’s words, however, was to deny art the unique, stand-alone power it must have in a modern society.

The trouble with Campbell is that he imagines the only way to speak truth to power is in a language you’re absolutely sure the powerbrokers understand. But the great cultural arbiters have always taken an altogether different approach. They have taken it upon themselves to reimagine the nature of power. They have set out to convince the people with the fat bank accounts and the political clout that transcendent values are urgently important, an essential aspect of a healthy democratic society. What the great cultural arbiters have always done is insist on the power of art in the face of other kinds of power—the power of bottom lines, flow charts, metrics, big data.

As they say in the old country, read the whole thing.

Around to See It

Whether it’s color, cash, inexperience or the ins and outs of renewable energy development in general, I often find myself tacking away from the original intent of the meaning of the essence of this site. But then some new article comes out to bring it all back around:

Another conclave of the global great and good is looking at what should be done in the much trickier area of climate change. The premise of the Global Commission on the Economy and Climate is that nothing will be done unless finance ministers are convinced of the need for action, especially given the damage caused by a deep recession and sluggish recovery.

Instead of preaching to the choir the plan is to show how to achieve key economic objectives – growth, investment, secure public finances, fairer distribution of income – while at the same time protecting the planet.

The author provides us the Kennedy space-race analogy as an illustration of the kind of efforts and leadership needed to curtail the effects of climate change, which is fine and well-meaning enough. But then he drops the second Pop-Tart® by suggesting that we need first to show/guarantee business the long-term benefits of greening the economy. I have one: how about you get to still have an economy?

That’s what the whole question is about: do we have enough greed to stifle the impulse toward self-preservation?

Okay – no one can use Enough Greed as a band name or an album title, because I just thought of it and realized its multitudes. Individual songs are fine as long as WDGM is ID’d in the bridge someplace.

Indy retailing Green

D.I.Y. is everywhere – look at this blog you’re reading, the e-book you could be reading there to the right. All of this is good, but it’s easy to be just a wasteful as large corporations, only on a small scale. But independent retailers can make being green part of their business plan from the get-go. A reader sends this handy guide:

D.I.Y. is everywhere – look at this blog you’re reading, the e-book you could be reading there to the right. All of this is good, but it’s easy to be just a wasteful as large corporations, only on a small scale. But independent retailers can make being green part of their business plan from the get-go. A reader sends this handy guide:

4. Reduce paper use. Print double-sided, reuse printed paper for scrap paper, and think before you print.

5. Buy local. When possible, source your products from local distributors or producers to reduce fossil fuel use.

6. Go digital. Switch to digital bill payment, invoicing, banking and ordering. You can also send email rather than printed memos or offer downloadable employee handbooks. Use an eFax service instead of a paper machine.

7. Get rid of Styrofoam. Styrofoam is one of the least environmentally friendly products you can use. Find alternatives to Styrofoam for everything from cups to packing peanuts, both in what you sell and in what you use in the warehouse.

It would be great if all of this was just common sense, but we’re not quite there yet. I particularly like number 19. Create incentives, reward people for not being in cars. We’ll get the message.

Image: symbol for independent decrease, used in mounting circuit breakers and industrial control equipment inside equipment racks, via wikimedia commons.

Meanwhile

I know there’s a lot of interesting stuff going on… what with all the face-eating bacteria and flesh-eating humans, but there is actually something else going on. The ‘business of America is business’ reality is actually taking over the country. The University of Virginia, founded by the revered Thomas Jefferson, is about to become the unofficial Citizens United test case for just how much can be run into the ground looted and sold bankrupted just like a business:

For as much as this has been described as “remarkable” and “unprecedented,” I can’t help but see it as the microcosm of a dynamic playing out in our politics and across our public institutions. The constant denigration of government and public service, coupled with the often unjustified veneration of business, has led to a world where successful capitalists are privileged in all discussions. In an earlier time, we understood that the values and priorities of the market weren’t universally applicable; of course you wouldn’t run a university like a business. It has different goals, serves different constituencies, and more important, has a broad obligation to serve the public.

The same goes for government. The Postal Service has never been a money-making operation, but that’s never been the point; as a country, we agreed that everyone should be connected, even if it doesn’t pay for itself. The value of public-spiritedness trumped the goal of profitability. You could say the same for Social Security, Medicaid, Pell Grants, Amtrak, etc. These programs should be judged by whether they accomplish the goals of our society—a safety net for the poor, help for the young, assistance for the old—and not whether they meet the metrics of a business. If they need reform to meet their goals, then we should move in that direction. But handing to them to the private sector, or running them like a business, won’t automatically solve their problems or make them better.

For the last thirty years, however, we’ve deferred to capitalists and businesspeople in nearly all decisions. A handful of rich people think they know how to run the economy? Great, we’ll let them take care of it. A few billionaires think they know what’s wrong with our education system? Well, we should listen to them!

It’s almost like 1876 all over again, except instead now with more updated, completely content-free b-school jargon.

Post With Left Sidebar

Donec sed odio dui. Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio sem nec elit. Sed posuere consectetur est at lobortis. Nulla vitae elit libero, a pharetra augue. Donec ullamcorper nulla non metus auctor fringilla. Donec id elit non mi porta gravida at eget metus. Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Etiam porta sem malesuada magna mollis euismod. Aenean eu leo quam.

Donec id elit non mi porta gravida at eget metus. Aenean lacinia bibendum nulla sed consectetur. Vivamus sagittis lacus vel augue laoreet rutrum faucibus dolor auctor. Donec ullamcorper nulla non metus auctor fringilla. Donec ullamcorper nulla non metus auctor fringilla. Integer posuere erat a ante venenatis dapibus posuere velit aliquet.

[quote align=”center” color=”#999999″]Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio sem nec elit. Integer posuere erat a ante venenatis dapibus posuere velit aliquet. Donec ullamcorper nulla non metus auctor fringilla.[/quote]

Pellentesque ornare sem lacinia quam venenatis vestibulum. Aenean lacinia bibendum nulla sed consectetur.Cras mattis consectetur purus sit amet fermentum. Sed posuere consectetur est at lobortis. Nulla vitae elit libero, a pharetra augue. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec id elit non mi porta gravida at eget metus. Vestibulum id ligula porta felis euismod semper. Vestibulum id ligula porta felis euismod semper.

Aenean eu leo quam. Pellentesque ornare sem lacinia quam venenatis vestibulum. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio sem nec elit. Integer posuere erat a ante venenatis dapibus posuere velit aliquet.

Post Different Thumbnail

Donec sed odio dui. Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio sem nec elit. Sed posuere consectetur est at lobortis. Nulla vitae elit libero, a pharetra augue. Donec ullamcorper nulla non metus auctor fringilla. Donec id elit non mi porta gravida at eget metus. Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Etiam porta sem malesuada magna mollis euismod. Aenean eu leo quam.

Donec id elit non mi porta gravida at eget metus. Aenean lacinia bibendum nulla sed consectetur. Vivamus sagittis lacus vel augue laoreet rutrum faucibus dolor auctor. Donec ullamcorper nulla non metus auctor fringilla. Donec ullamcorper nulla non metus auctor fringilla. Integer posuere erat a ante venenatis dapibus posuere velit aliquet.

[quote align=”center” color=”#999999″]Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio sem nec elit. Integer posuere erat a ante venenatis dapibus posuere velit aliquet. Donec ullamcorper nulla non metus auctor fringilla.[/quote]

Pellentesque ornare sem lacinia quam venenatis vestibulum. Aenean lacinia bibendum nulla sed consectetur.Cras mattis consectetur purus sit amet fermentum. Sed posuere consectetur est at lobortis. Nulla vitae elit libero, a pharetra augue. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec id elit non mi porta gravida at eget metus. Vestibulum id ligula porta felis euismod semper. Vestibulum id ligula porta felis euismod semper.

Aenean eu leo quam. Pellentesque ornare sem lacinia quam venenatis vestibulum. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio sem nec elit. Integer posuere erat a ante venenatis dapibus posuere velit aliquet.

Eco-Nomics

It always seems like your eyes glaze over before you get to the end of the word. But, hyphenate it… Hey! now we’re talking.

Or they were talking – Washington Post blogger Ezra Klein and James Galbraith.

EK: You think the danger posed by the long-term deficit is overstated by most economists and economic commentators.

JG: No, I think the danger is zero. It’s not overstated. It’s completely misstated.

EK: Why?

JG: What is the nature of the danger? The only possible answer is that this larger deficit would cause a rise in the interest rate. Well, if the markets thought that was a serious risk, the rate on 20-year treasury bonds wouldn’t be 4 percent and change now. If the markets thought that the interest rate would be forced up by funding difficulties 10 year from now, it would show up in the 20-year rate. That rate has actually been coming down in the wake of the European crisis.

So there are two possibilities here. One is the theory is wrong. The other is that the market isn’t rational. And if the market isn’t rational, there’s no point in designing policy to accommodate the markets because you can’t accommodate an irrational entity.

You should read it. So much of the conversation about deficits, recessions, taxes and stimulus that goes on is just wrong. It’s a way to punch a hippie, push an agenda, empower corporations, screw the poor or some combination of all of these. You’d have to understand, very deeply, a lot of this stuff to be able to call bullshit on the faux-populist balderdash that gets most of the play most of the time (for instance, the business page in any newspaper taking a sour attitude toward statistics or policy measures that benefit workers). This guy does. Check it.

The Path to Dominance

World dominance, that is. For China:

The main challenge from the world’s new industrial superpower is not that it will continue to use the dirty, old technologies of the past, but that it will come to dominate the new, clean, green ones of the future.

As developed nations fail to put an adequate price on carbon, and thus to stimulate clean-technology development themselves, they risk handing market supremacy to the rival they most fear. Indeed, it could even be hypothesized that China’s blocking of agreement on rich-country emission targets in Copenhagen was intended to hold back the development of cleantech by its Western rivals.

An interesting question for business minds, at least. Business/finance/economic growth thinking – that drives investments in infrastructure, engineering and technology, not to mention general promotion of cultural shifts – has been consistenty wrong about the solutions to climate change. There’s a reason business interests – so-called – keep being on the wrong side of this issue. What exactly is the challenge that is being misunderstood? At its best, enterprise sees opportunity everywhere, even in threats. Check out the tone of the recent proceedings in Copenhagen. When has such an opportunity seemed like such a threat?

And remember: we’ve got quite a record in the face of really big challenges – 9/11 (Iraq did it?), the Soviet threat (from a rusting, empty shell of a superpower?). And while much of this ignorance might have been purposeful, it doesn’t make it look any less stupid in hindsight – though nothing will compare with even the middling scenario of irreversible environmental devastation that will result from doing nothing about climate change out of some affinity for cost-benefit analyses. Talk about stupid. In other scenarios we’d apply for a patent.

So this is the double-whammy for the world’s leading economy. If we [still] want to become something other than the world’s leading army, there must be serious improvement in geo-political business understanding. As the article points out, even Little Tommy Friedman gets this (which, I admit might normally undermine the reality. But not this time.) From a frantic, stock/futures market perspective, what happens in the next couple of years will determine if the U.S. and American companies will be competitive in clean energy development in the decades to come – or whether we will be colonized by Chinese solar and wind companies like the Chinese were with soft drinks, cell phones and fast food brands.

What happened to all that ruthlessness?

Money Can Buy

Fairness and justice can inform politics, invigorate its supporters and infiltrate the ranks of decision-makers to influence the use of government and guide the course international cooperation.

So can business.

And now the Gates Foundation has finally named a new director of agricultural development—a position left vacant since April, when Rajiv Shah left to take a post at USDA. (Shah is now director of USAID within the State Department—the top development position in the U.S. government). The foundation named long-time biotech exec and investor Sam Dryden to the post.

In doing so, the foundation could hardly have sent a stronger signal: In its vision, at least, Africa’s future as a prosperous continent hinges on the benevolence of patent-wielding Western biotech behemoths like Monsanto and its very few peers in the GMO-seed space. Here is how The Seattle Times describesDryden’s background:

At Wolfensohn and Company, which was founded by former World Bank President James Wolfensohn, Dryden focused on investments in alternative energies. He formerly headed Emergent Genetics, which develops and markets seeds. Emergent Genetics, the third largest cotton seed company in the U.S., was acquired by Monsanto in 2005 in a $300 million deal. [Emphasis added.]

The tools are malleable, not permanently bent. The reasons for optimism are also the reasons to be skeptical. On neither count should we underestimate the power of vital green interests.