Notwithstanding the [late] reckoning with our very own special coup, the one we think we dodged and the very one over which Our Media is fascinated by exactly all the wrong details; the battle between Chicago and lake Michigan; and the new Gilded Age space flights for plutocrat tourists, the economy seems to have magically withstood a pandemic (Narrator: It’s not magic):

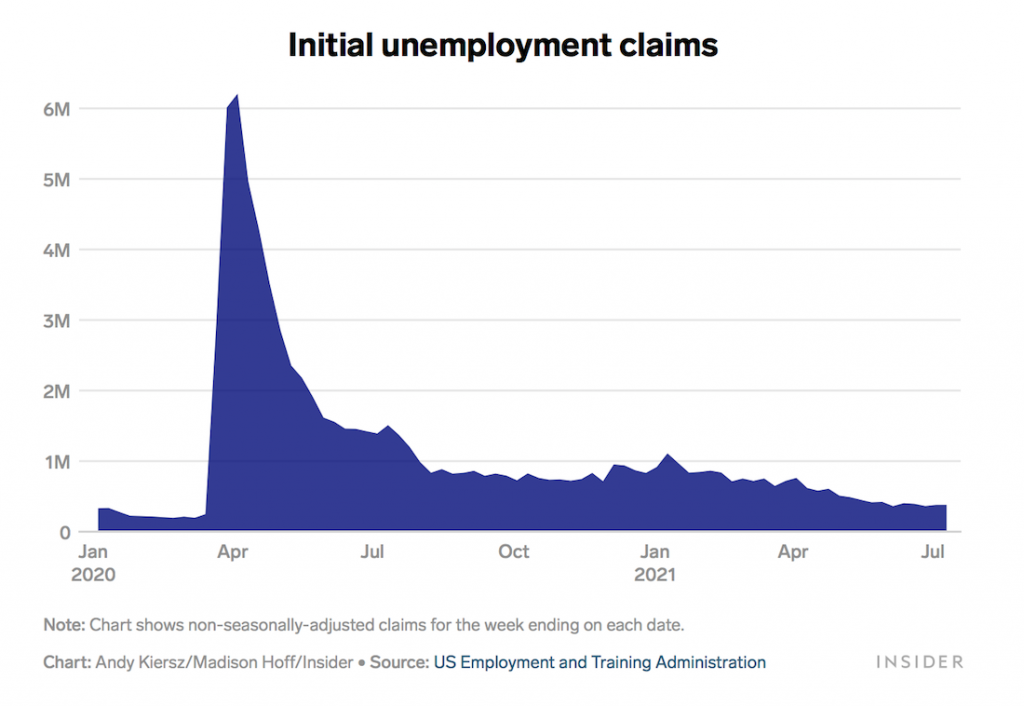

Initial unemployment claims came in at 360,000 for the week ending July 10, below the previous week’s revised read of 386,000. That reading matched the consensus forecast among economists, according to Bloomberg.

The decline in the seasonally adjusted number resumes the overall downward trend of the volatile data series after an unexpected rise in initial claims last week. The Labor Department noted that this marks a new pandemic-era low.

While the number of Americans newly filing for unemployment benefits tends to bounce around from week to week, it’s been on a general downward trend after spiking to record-shattering numbers amid the early days of the pandemic last spring. The return to that downward trend matches other data suggesting a steadily recovering labor market.

360K is still a very many lot of people, and yet you ask: after years of making sure our billionaires had enough nest eggs to color-coordinate their space suits, how was it possible to get through a year of very limited economic activity and still be able browse and sniff at the want ads and generally avoid most of the fascist tendencies on offer? Give. People. Money.

CARES and PPP run themselves out by design, which is helping people stay afloat. This is why we’re longing for vacations instead of standing in breadlines. And the infrastructure bill will bring more of this – not gifts and not luxuries – but investments in people and how we live, with recommendations for new arrangements for different needs that WE have made absolutely necessary (see Chicago example above and read the history). Move the monuments. Buy the trains. Pay the carpenters, or become one. As legend has it, the profession has a storied past.