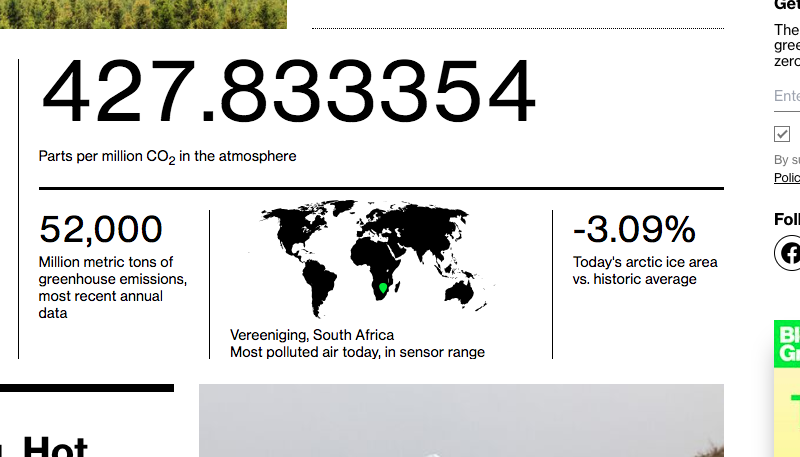

Reminiscent of the fabled National Debt clock, Bloomberg Green sports a running, parts per million CO2 counter that clicks up and down at various speeds depending on, well, you can check it out.

Despite some with fancy hats acting interested in horse racing, versus others in famine-plagued refugee camps, there is a great bit of unanimity of experience in our current moment. Some dissonance concerning the effect of heat on the Miami Grand Prix notwithstanding, the inability to escape the unusual effects of global warming unites us all, on a way. Not the good kind, yet still, unity toutefois.

One of the questions is whether this great common crisis may elicit in us urgency for collective action that serves the greater good. And yes, cynicism circles the globe twice every morning before hopefulness pours its first cup. But this forced grouping of everyone with everyone else no matter your station under the banner of This Is Happening kicks our profit-maximizing distraction seeking onto a side street. And you know how people like to browse.

There are many things to see. Maybe you consider picking up something special – like something for someone everyone else.