New York Magazine takes us on a tour of what lays beyond, after the capitalism runs out. That may sound hippie and/or conspiratorial, but facts is facts and the entire game has changed:

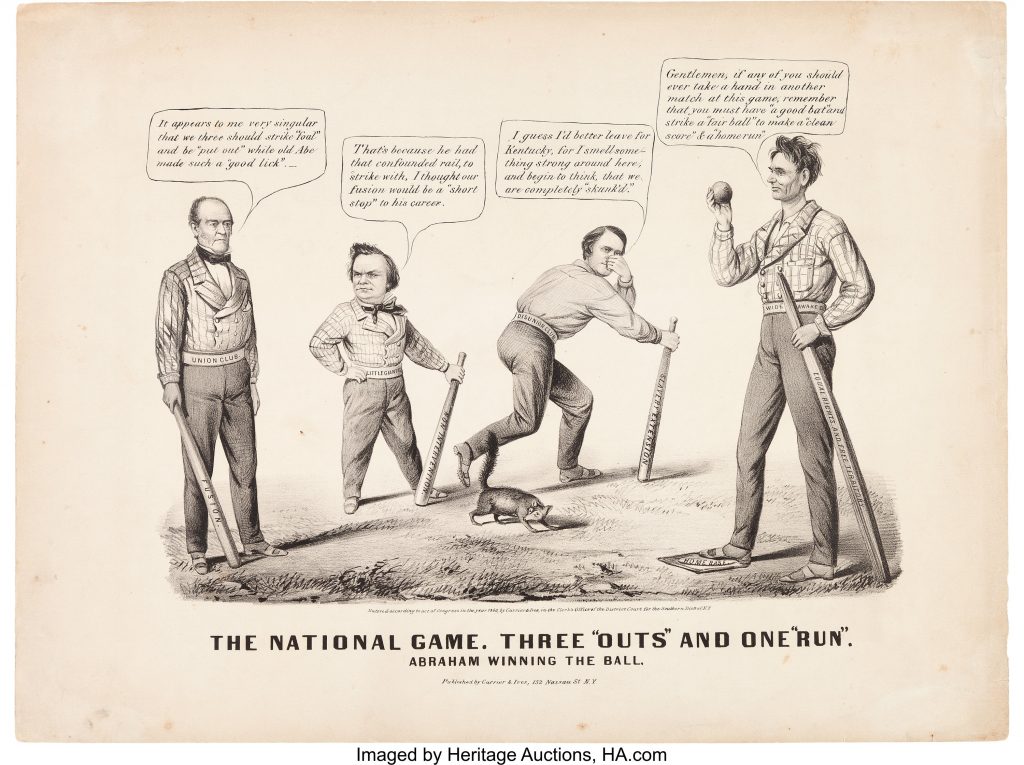

Making matters even weirder, contemporary capitalism’s dominant shareholders have no direct interest in the success or failure of the firms they own. All returns on their holdings get passed down the investment chain to their clients — households, governments, and corporations. Asset managers make their money off of their clients’ fees, not their firms’ returns. This diagram may make the hydraulics of the system more legible:

[cool graphic]

Of course, an asset manager that delivered consistently poor returns would attract few clients. And asset managers’ fees are calculated as a percentage of the current value of their clients’ assets. Nevertheless, add a fee-based business model to asset managers’ universal portfolios, and their interest in the performance of any individual firm they own becomes extraordinarily attenuated — even when they are the single largest shareholder of that firm (which is very often the case)!

This is not how capitalism is supposed to work in theory. And it isn’t how corporate governance has ever before worked in practice. To the political economist Benjamin Braun, the contemporary structure of corporate ownership is so novel and consequential as to mark a new era in economic history, the age of “asset-manager capitalism.”

Braun’s papers on this subject are fascinating, and nerds will want to read them in full. Mere dorks, however, may be content to consider the following four ways the rise of asset managers challenges conventional wisdom about how capitalism functions — and how it might be changed.

Cool graphic and the rest at the link. Removing market competition from the equation renders many of the other legacy levers moot. Even the ESG stratagem takes on a different tenor – what does promoting efficiency even mean when the owners of the means of production no longer prevail – when/if we default (curious wording) to a dirigiste model. They, ESG pressure campaigns may become more effective. Because frankly, christian soldiers, that’s what they’re talking about.