Between Canada and the United States? Between clever and stupid? You’re getting warmer. Try the critical dividing line between credit creation and value creation. Seeing these as one in the same is like, well, looking at the huge land mass between Panama and the North Pole and seeing a single, harmonious country. It’s not all the same, though it would change much if some solidarity formed around being North Americans, not all of it good.

There is some good, bad and wrong in this article. The author points to some interesting distinctions that have been missed, or at least underplayed, concerning credit and value.

There are some simple rules for sound banking and sound economies that need to be followed: Whenever credit is created and used to increase the amount of goods and services provided, it will be noninflationary: more money comes about, but also more goods and services. This is boring banking, without excessive bankers’ bonuses. But it is the kind of stable banking that created the postwar German and Japanese economic miracles, and also explains the rise of China and other East Asian so-called miracle economies.

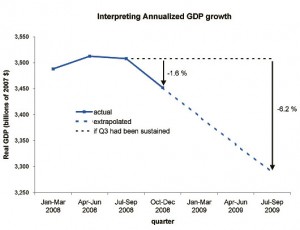

But whenever credit is created and used for unproductive purposes, inflation comes about: more money chases a limited amount of goods or assets. The unproductive credit creation can take two forms: When credit is extended for consumption, it will result in consumer price inflation. When credit is extended for non-gross domestic product transactions (which means mainly financial and real estate transactions), there will be asset inflation. Both cases are unsustainable and if sufficiently large, result in banking and economic crises.

We can be more or less strict about any of this from a regulatory point of view, but what banks create with credit largely defines how we lope from bubbles to busts to bubbles again. Bankers were once (and will be again soon) the stiff, uptight types whose very boringness epitomized financial prudence featuring risk aversion, right down to their Brooks Brothers’ suits. This is the boring banking of low, constant annual returns – you may have heard of it. Though they may have been disparaged from time to time as prudish stereotypes, there was a certain reliance on them as a personification of the confidence we could place in the system. Credit was slow moving for a reason. But when, as the writer points out, credit is created and used for unproductive purposes, all manner of skulduggery becomes possible.

And here’s the civics class section that coach skipped over – when something involving money becomes possible in our system, it’s as good as mandatory.

We get exotic financial instruments and bankers in Zegna and Armani spinning a whole different kind of confidence game. These episodes, if that’s all they are, point back to an economy abandoned of its fundamentals, where people are making money off of money that, it turns out, isn’t real money. Inflated value is not real money, so you should not be able to get easy cash (more debt) in return for not having it.

Q: How can you afford a $789,000 home financed at 5.8% if you’re not an anesthesiologist?

A: You can’t.

There are all manner of warning signs that no one wants to believe (Dow 36,000?) and it’s easy to look back and say well, we should have known, what with all those e*trade commercials during breaks in ‘Flip that House’, you could see greed getting the best of the least among us first*. Yes, we should have and in fact many, many people did refuse the basic temptation to jump in and not get left out of the gold rush, which was based on nothing more than self-conjured pool of suckers-R-us.

* I’m thinking of the conscience-challenged here, first, but there’s a growing body of evidence which suggests some preternatural disposition toward not asking questions if the answers keep coming at a 30% annual rate of return.