I can dig it when the Grey Lady steals my construct.

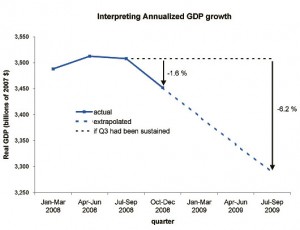

On Friday, the Bureau of Economic Analysis reported that gross domestic product fell at an annualized rate of 6.2 percent from the third to the fourth quarter of 2008. This was bad news, but some journalists have exaggerated the finding merely by misreading the report.

That post and graph is by a UChicago economist. Another economist I read regularly is Brad DeLong at Berkeley (who hopefully will be taking academic leave to work at the Treasury department very soon). Anyway, this post reminds me of something I heard DeLong say in a NPR essay, I think yesterday. He was talking about all the bad news that’s out there, about the fixation on the stock market as an indicator, the unemployment numbers, the CPI… and he was saying that its enough to make us all worried and scared. But he pointed out that because of certain trends in the fundamentals of the economy (which have been out of whack for several years, really), the stock market should be going down. And though we’ve known about most all of these trends and statistics since last fall, the news media has been more all over them of late. So while they are sufficiently dire that we should be worried and scared, we shouldn’t be more worried and scared than we were in December just because the news media is finally rending their garments.

But… check out DeLong; he has a great running gag (except its not so funny) about the Washington Post Death Watch that should serve him well when/if he gets back to DC.