With some ferocity, I usually resist the impulse to delve into matters financial. But this Dr. K item on GE Capital seems both clear-cut and easy-to-understand:

With some ferocity, I usually resist the impulse to delve into matters financial. But this Dr. K item on GE Capital seems both clear-cut and easy-to-understand:

Most economists, I think, believe that the rise of shadow banking had less to do with real advantages of such nonbank banks than it did with regulatory arbitrage — that is, institutions like GE Capital were all about exploiting the lack of adequate oversight. And the general view is that the 2008 crisis came about largely because regulatory evasion had reached the point where an old-fashioned wave of bank runs, albeit wearing somewhat different clothes, was once again possible.

So Dodd-Frank tries to fix the bad incentives by subjecting systemically important financial institutions — SIFIs — to greater oversight, higher capital and liquidity requirements, etc.. And sure enough, what GE is in effect saying is that if we have to compete on a level playing field, if we can’t play the moral hazard game, it’s not worth being in this business. That’s a clear demonstration that reform is having a real effect.

Bold is mine, because this is key, both to Dodd-Frank and what largely works for business in the U.S. today at the behemoth level. Orwellian language about fairness and tax burdens and putting America to work [again] is just that – all myth. The megacorps want every tactical advantage to operate as alpha predators, forcing all non-megacorp entities to use language like this to accurately describe their actions. It’s win-win, and very savvy of them. Terrible for everyone/thing else. But his little crack of light – an admission that they can’t play if those are the rules is telling, so let’s listen.

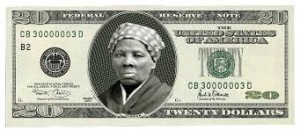

Image: will we put American heroine Harriet Tubman on the $20 bill?