Or… sexier than ape cartoons.

My head, it shakes. Because no matter how seriously and soberly one might approach the financial dilemma of bringing promising technologies to maturity by broad investments, there are always hand-scrawled love notes, or pictures of pictures, or the newest version of L.H.O.O.Q., not to mention instant toothbrush delivery schemes to entice the ridiculously wealthy or even the passingly prosperous. It’s a problem:

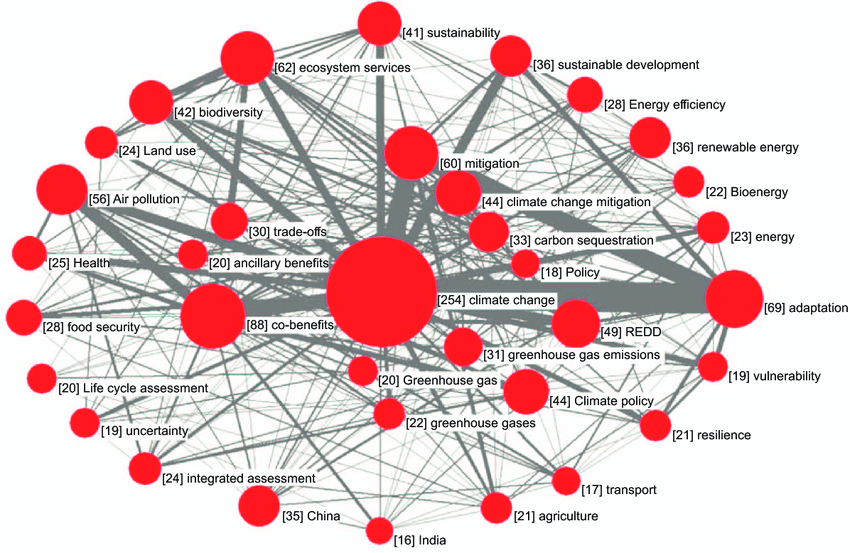

Tony Fadell, who spent most of his career trying to turn emerging technologies into mainstream products as an executive at Apple and founder of Nest, said that even as the world faces the risks of climate change, money is flooding into less urgent developments in cryptocurrency, the so-called metaverse and the digital art collections sold as NFTs. Last year, venture capitalists invested $11.9 billion in renewable energy globally, compared with $30.1 billion in cryptocurrency and blockchain, according to PitchBook.

Of the $106 billion invested by venture capitalists in European startups last year, just 4% went into energy investments, according to PitchBook.

“We need to get real,” said Fadell, who now lives in Paris and has proposed ideas on energy policy to the French government. “Too many people are investing in the things that are not going to fix our existential problems. They are just investing in fast money.”

Even so-called ESG funds and investor movements run the risk of becoming fads, passing, allowing a regression toward the mean, also know as same old, same old. Governments have to do more to leverage current investments and attract new. But there also has to be some boring seriousness to guide the reckless speculation, as contradictory as that sounds. Otherwise, we’re still speculating alright, on something.

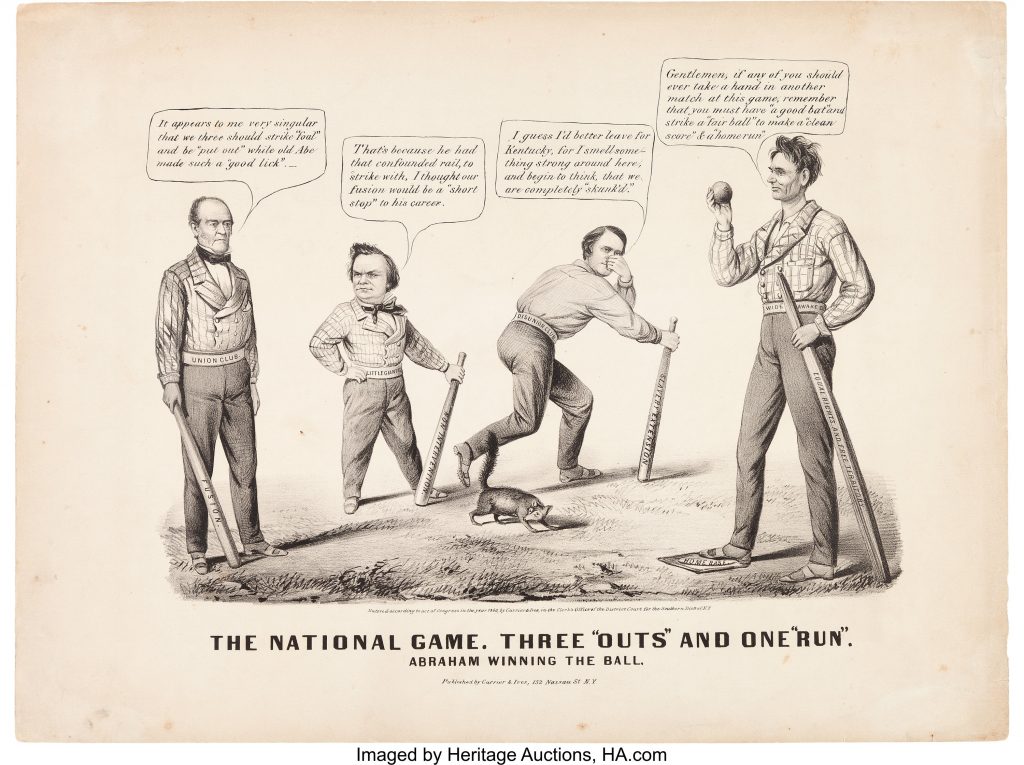

Image: Not a new version. Duchamp would be kicking himself