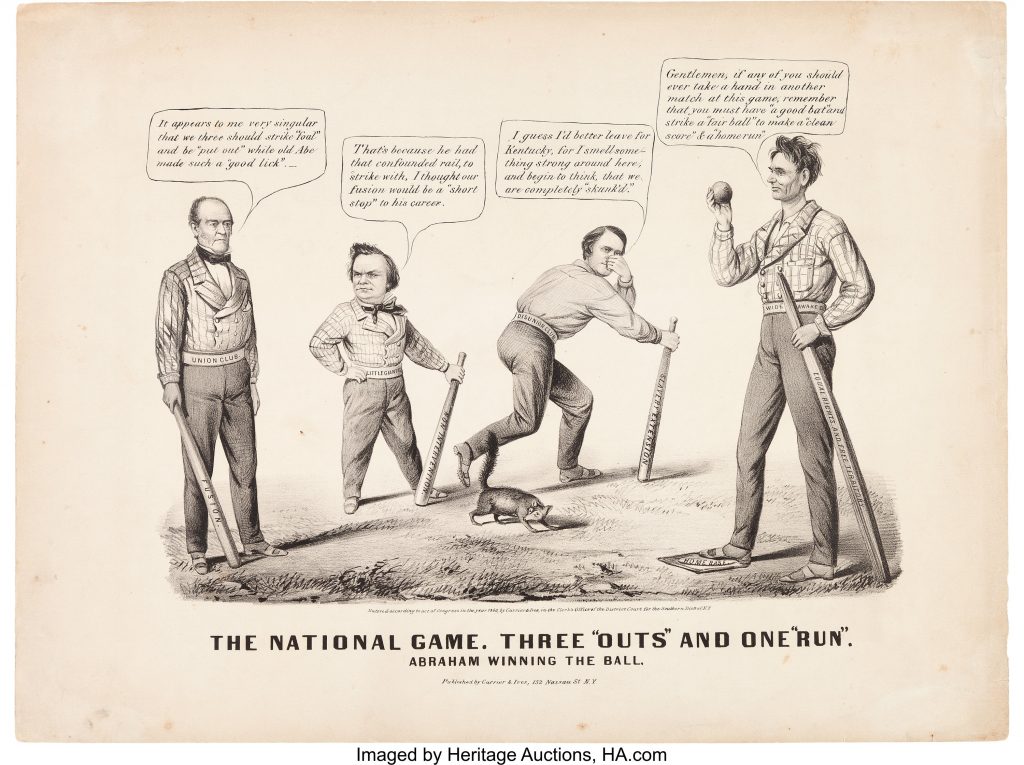

This is some serious inside baseball. But it IS October:

If your basic theory of ESG investing is “we will avoid bad-ESG stocks in order to drive up the cost of capital of bad-ESG things,” it seems to be working:

Years of awful returns and pressure from clients to exit from the oil-and-gas business have left fewer and smaller firms able to take advantage of rising prices and help boost production. The unwillingness of some banks to make energy loans has compounded the challenges to boosting energy supplies.

Those left are moving to increase production, but they are relatively small players who won’t be able to make a significant impact on output. Investors are steering capital away from fossil fuels and toward companies that rank high in environmental, social and governance, or ESG, measures.

“Oil-and-gas has seen the worst returns of any sector over the past five years; the returns are volatile and investors feel ESG pressures,” says Wil VanLoh, who runs Quantum Energy Partners, which manages $18 billion, making it one of the few remaining big energy private-equity funds. “There’s been a huge retreat in available capital.”

That’s from Matt Levine’s Bloomberg daily newsletter, talking game about the game. But the idea that ESG investing is maturing, as he says, is an interesting one. If companies and the courts are no longer going to just line up on the side of fiduciary responsibilities as a way to protect shareholders – and hence, the companies that may continue to pollute and spew for profit – that’s at least a change.

Image: Abraham Lincoln: Baseball Theme Currier & Ives Cartoon, 1860.