It’s important to step back for a moment and consider the scrum from which the hype around Artificial Intelligence arises.

Even without casting [m]any aspersions on the tools as they are bandied about – and there ARE documented, purposeful uses for crunching data with super computers, from folding proteins to finding exoplanets; real stuff and revolutionary for these fields – the general rush to embrace AI for all sorts of, let’s say, less purposeful application should be acknowledged.

After decades of artificial sweeteners, fabrics, food, and foliage, and of course the accompanying, devastation of health impacts and pollution from plastics, PCBs, and many more, a noticeable shift toward the all-natural, hand-selected, bespoke, organic, non-invasive ensued, at least in the marketing materials. This acknowledgement, more human-centered, initially had a kind of desperate last-gasp tone to it that morphed into a realm of preference, if not elevated choice. Thanks, branding!

But it was more than that, and the shift itself coincided with a growing awareness about the dangers of this fakeness and its seamless integration into the activities as well as the mindset that led to and accelerated global warming.

So, now – if you’re keeping score at home – because some of our overlord disruptors in Silicon Valley need to get in on the ground floor of the next new thing, we’re ready to reek further devastation on the information and images we use to navigate the world. It’s not enough to use the verb ‘consume.’ Once we began to use the word and consider ourselves consumers and now just customers instead of citizens, students, patrons, whatever, everything else became easier. And by everything else, I refer to most things unpleasant, empty, lesser, vapid, wasteful of your time, and detrimental to your heart. Yes, doesn’t that sound quaint. Your heart, come now! C’est drôle.

It’s not that the next new thing could destroy us, but that we are so happy to play our part in the destruction. Suddenly we’re helpless to watch another dynamic seize control of how we navigate the physical world as humans. You need not be an AI skeptic to be a tiny bit underwhelmed by that prospect.

The next new thing after this (not investment advice!) will surely consist of selling us back the key to imagination(tm) we somehow lost because everything is fake.

We worry about AI taking jobs but do our part in cheer-leading the takeover, in wonder no less at the ease with which it all happens and the productivity gains sure to follow. In this senseless meandering from one shiny thing to the next, AI might appear to be just another trend we might try, even get used to. Meanwhile, our only job ever has been to discern not the good from the bad, but the real from the fake.

Natural selection, by humans. Darwin should have been more specific.

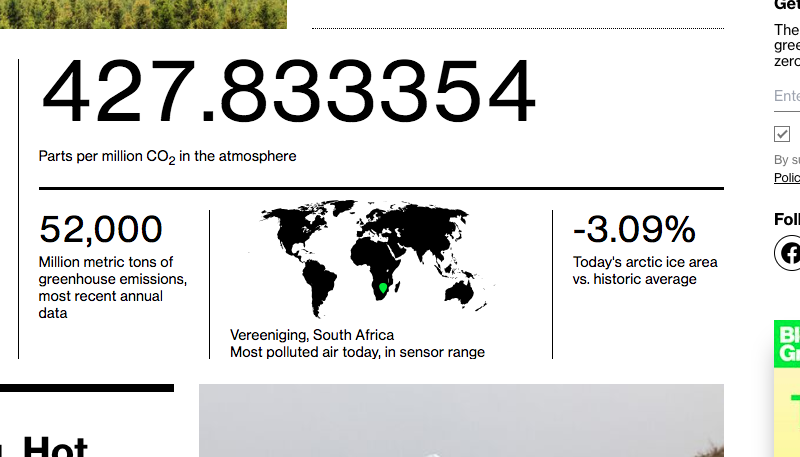

And by the way, I’m not at all amused by the extent to which this all rhymes with the original rationale I presented for the green blog, oh so [no that] many years ago.