Funny thing about Green buildings – we need them! That’s decidedly unfunny BUT… timing is very important as far as the technology available and what seems most durable when architectural engineers choose how to power the building. Especially if it’s innovative and edgy:

Some of the building’s most important green features were the right answer to the climate problem in 2016, when design work was completed. “And then the answer changed,” Mr. Wilcox said.

Unlike many skyscrapers, One Vanderbilt generates much of its own electricity. This was a leap forward a decade or so ago — a way of producing power that saved money for landlords and was cleaner than the local grid.

However, One Vanderbilt’s turbines burn natural gas. And while natural gas is cleaner than oil or coal, it is falling from favor, particularly in New York City, which in recent years has adopted some of the most ambitious climate laws in the world, including a ban on fossil fuels in new buildings.

As that transition happened, SL Green was caught in the middle. Although One Vanderbilt went up relatively quickly, topping out after three years, its owner had to watch as the city’s environmental strategy raced forward.

The building is one of those skinny, ribbon skyscrapers in Manhattan. And they had the right idea. Kind of. It was right at the time, which seems like, well, ouch.

It is akin to many familiar things, like choosing a vocation that will interest you for decades and hopefully longer. It can be tricky, based on what you think is out there. If you choose a life of exploration – artistic, scientific, whatever – you throw the rock (the thing you’re chasing) as far as you can. Hopefully the journey to finding/achieving takes a long time, years, enough time for you to develop as a finder of such things.

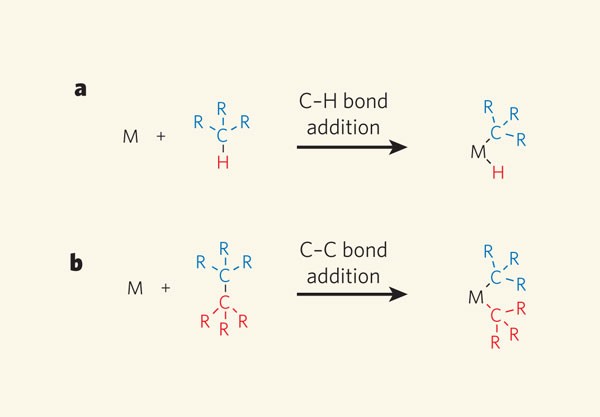

Building is slightly different, as it is so permanent. So… go with ancient designs or new bells and whistles? It’s a gamble, much like choosing a vocation, if you are so fortunate. Choose wisely.

Image: an ancient design, Le Pont du Gard